Invest in Shares or Property in 2024?

As we start 2024 the goals of how we are going to make changes to our life whether it’s health or no longer hoarding become an annual ritual.

It’s common to get in the cycle of work, eat, sleep then another new year repeats.

I am not writing this to try and be a mindset coach but instead to put it out there, how will you generate wealth over the coming years and into later life?

A worthy discussion we should all be having whether with family, friends or ChatGPT.

How you generate your wealth depends on your appetite for risk, goals and timeframe but it’s safe to say property has served generations of Aussies well for many years.

It’s a tangible asset that has far less speculation than shares due to less variables influencing performance and it is something we all need, it will always have utility.

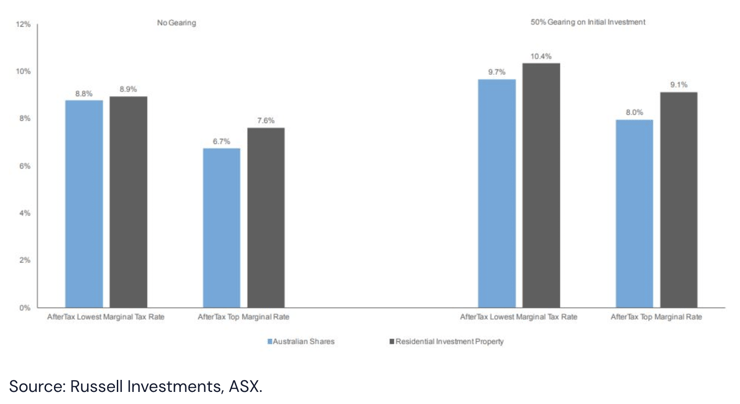

In June 2018, a report jointly published by the ASX and Russell Investments analyzed the returns of long-term investments.

The findings, as shown in the table below, revealed that over the 20-year period, residential investment property demonstrated superior gross returns.

The table shows those in a top marginal tax rate benefited more however according to the report Australian shares had an average annual return of 8.8%, whereas Australian residential property had an average annual return of 10.2% over a 20 year period.

Success hinges on the expertise of the property investor and how their finance is structured. A good mortgage broker, financial planner and accountant are worth every penny.

Identifying an investment grade location is not easy even with the wealth of information we have these days, in fact it makes it harder. Who do you trust, which strategy works and are they getting kickbacks for their service?

Trust and expertise are key. Aligning yourself with independent sources of information and proven leading analysts is essential when choosing to use property as a vehicle for wealth creation.

I am not advocating to not invest in shares however over the long term you can’t ignore, when the right location and property type is selected your returns will be greater than pursuing the share market.

Matt Gibson

January 30, 2024

Matthew Gibson

Keen researcher and on the ground Gold Coast Buyers Agent