How did we get here?

I have these conversations daily about how expensive Gold Coast property is and it fascinates me how this growth happened in such a short space of time.

So, I wanted to share a known phenomenon in financial markets known as reflexivity to give myself and the reader a better understanding of the drivers behind how we got here so we make better investment decisions into the future.

The population growth has always been steady on the Gold Coast but the pandemic created a unique environment due to lockdowns.

Our locked up neighbours interstate and those overseas were told to stay indoors, limit your contact with others, don’t sing or dance otherwise you will be fined.

The fear during this time contributed to a social phenomenon in financial markets termed ‘reflexivity’.

George Soros, one of the most successful investors of all time came up with the reflexivity theory and states, investors don't base their decisions on reality, but on their perceptions of reality instead.

In the case of Gold Coast property prices during the pandemic their perception of reality was fear of the unknown and missing out.

Prices went up beyond our imagination because of the surge in demand from the population growth buying with irrational perceptions of reality at that time.

This social phenomenon matched with low interest rates and the banks tripping over each other to write more loans created a self reinforcing feedback loop in the market where it observed itself and reacted causing prices to pump.

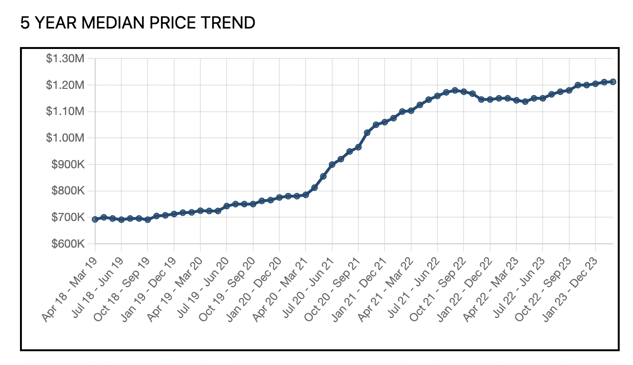

The Elanora, Qld chart below from PropTrack shows the steep rise in median price occurring mid 2021 when we went into lockdown and it's fair to say the perception of reality for the majority of the population at this time was full of fear and emotion.

There are some that say, it was about time Gold Coast caught up to the capital cities but for many these prices are detached from reality.

The knock on effect of the Pandemic was supply of goods dried up, inflation rocketed, interest rates rose and money dried up for developers and builders.

This choking supply has kept prices steady with no sign of reversing and now prices are a reality.

It’s worth understanding how we got here - lack of supply and high demand driven by emotional behaviour and our perception of reality as opposed to objective reality.

Understanding this can help us make better investment decisions into the future. Who is buying and why.

History doesn't repeat but it often rhymes.

Matt Gibson

April 9, 2024

Matthew Gibson

Keen researcher and on the ground Gold Coast Buyers Agent