A Shift in Expectations?

Australia is still the lucky country but is the aussie dream to own your own home and proudly mow your lawn in your double pluggers and singlet becoming less likely?

Is the expectation to own the freehold home shifting among the Gold Coast population?

Consider the current rental crisis. Tenants are asking themselves how they can secure the roof over their head instead of worrying about the landlord raising rents or asking them to move out.

Do they keep renting or if fortunate enough save for a deposit to buy a house?

Locations where most have grown up and want to live will find this deposit a moving target. A target that is shifting further away each year.

There are many reasons why this target is shifting and I don’t claim to know all of them but whether it’s the weakening of the dollar due to inflation and money printing or free market fundamentals of supply and demand. Either way for many that lawn ain’t getting mowed.

From talking to agents and buyers on the ground there appears to be a shift in expectations of where to live and dwelling types too. Buyers are willing to sacrifice the dream home for now and get a unit simply to secure a roof over their head.

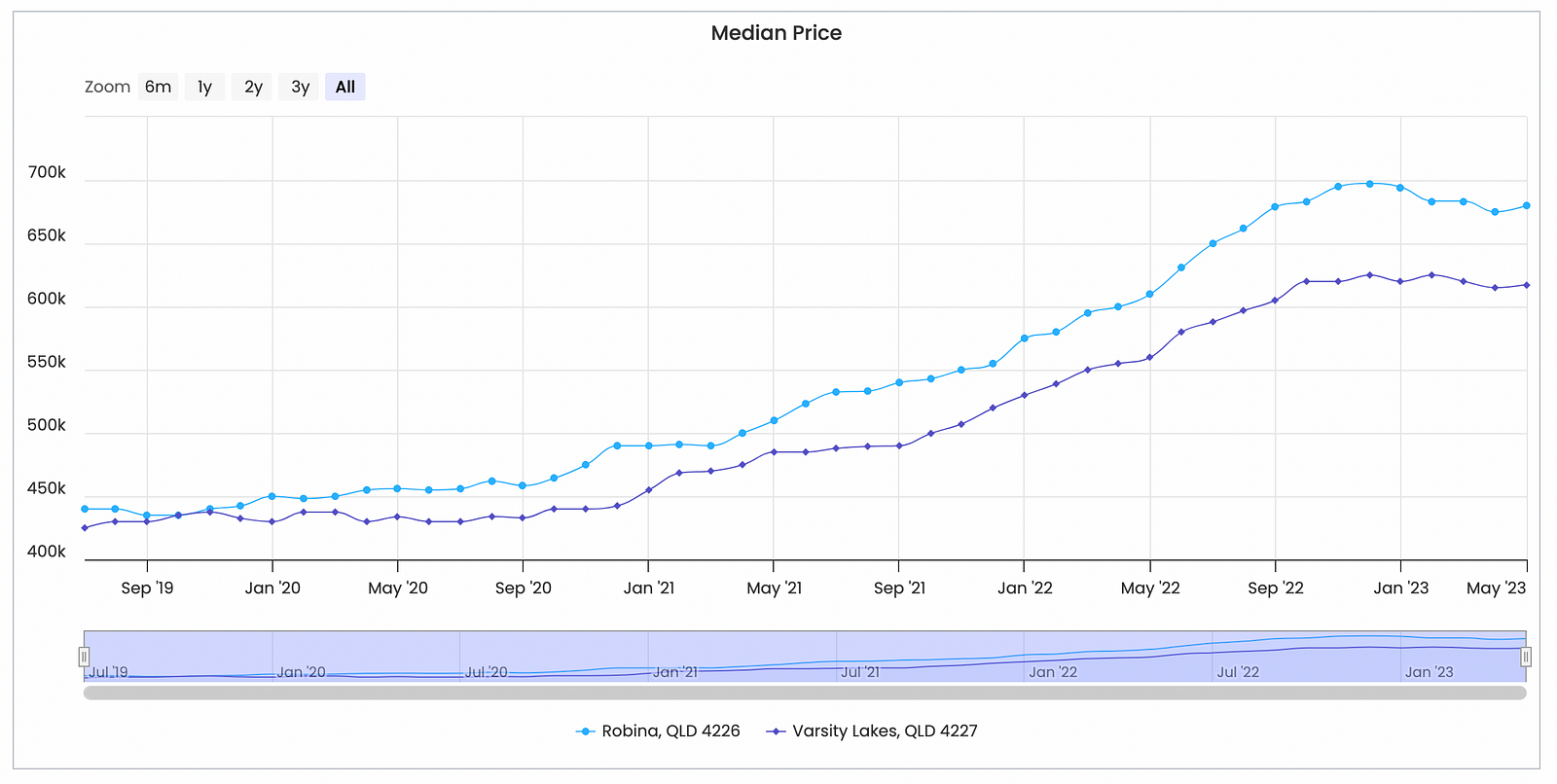

Unit median price for Varsity Lakes and Robina has shown a steady increase since the start of 2021.

The consensus among many was that prices are not sustainable and will drop however the charts below show this has gone against what many forecasted.

Chart by Suburbsfinder — Median Unit Price for Robina & Varsity Lakes

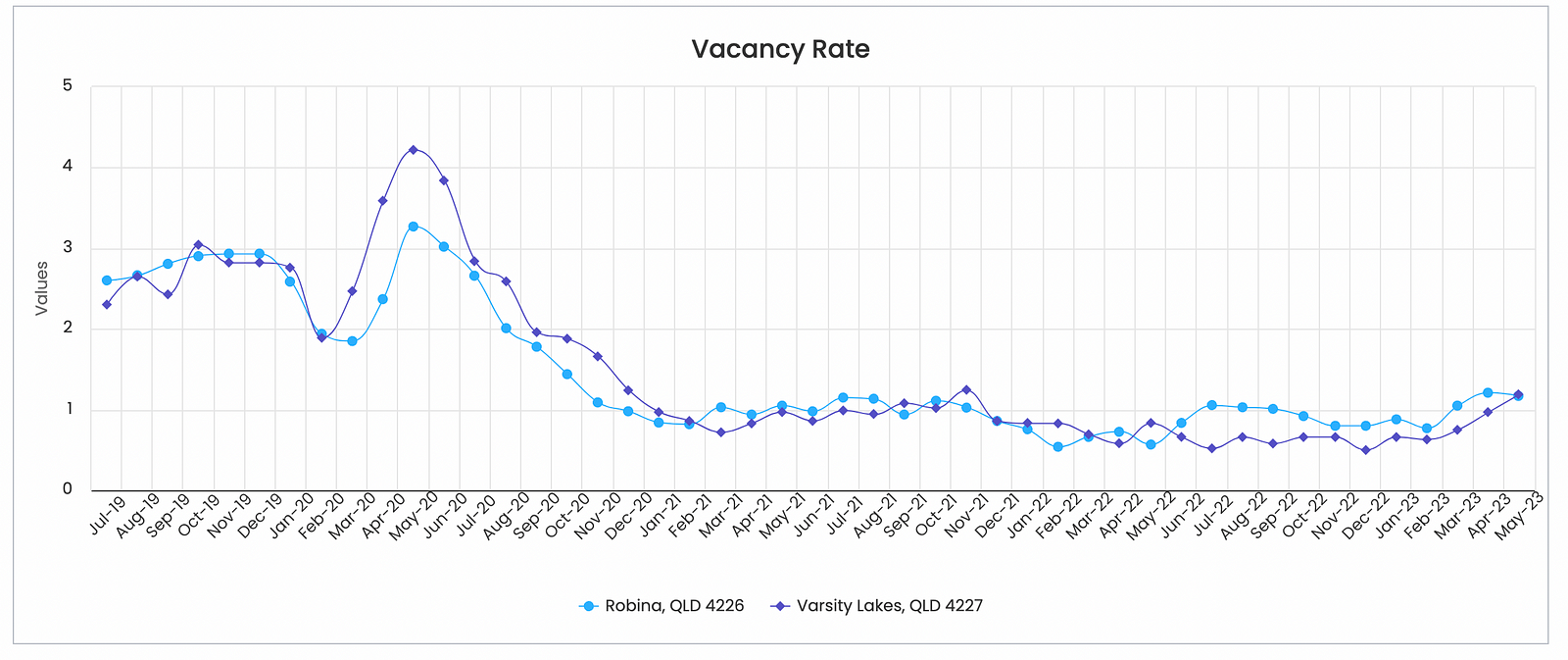

Chart by Suburbsfinder — Unit Vacancy Rate for Robina & Varsity Lakes

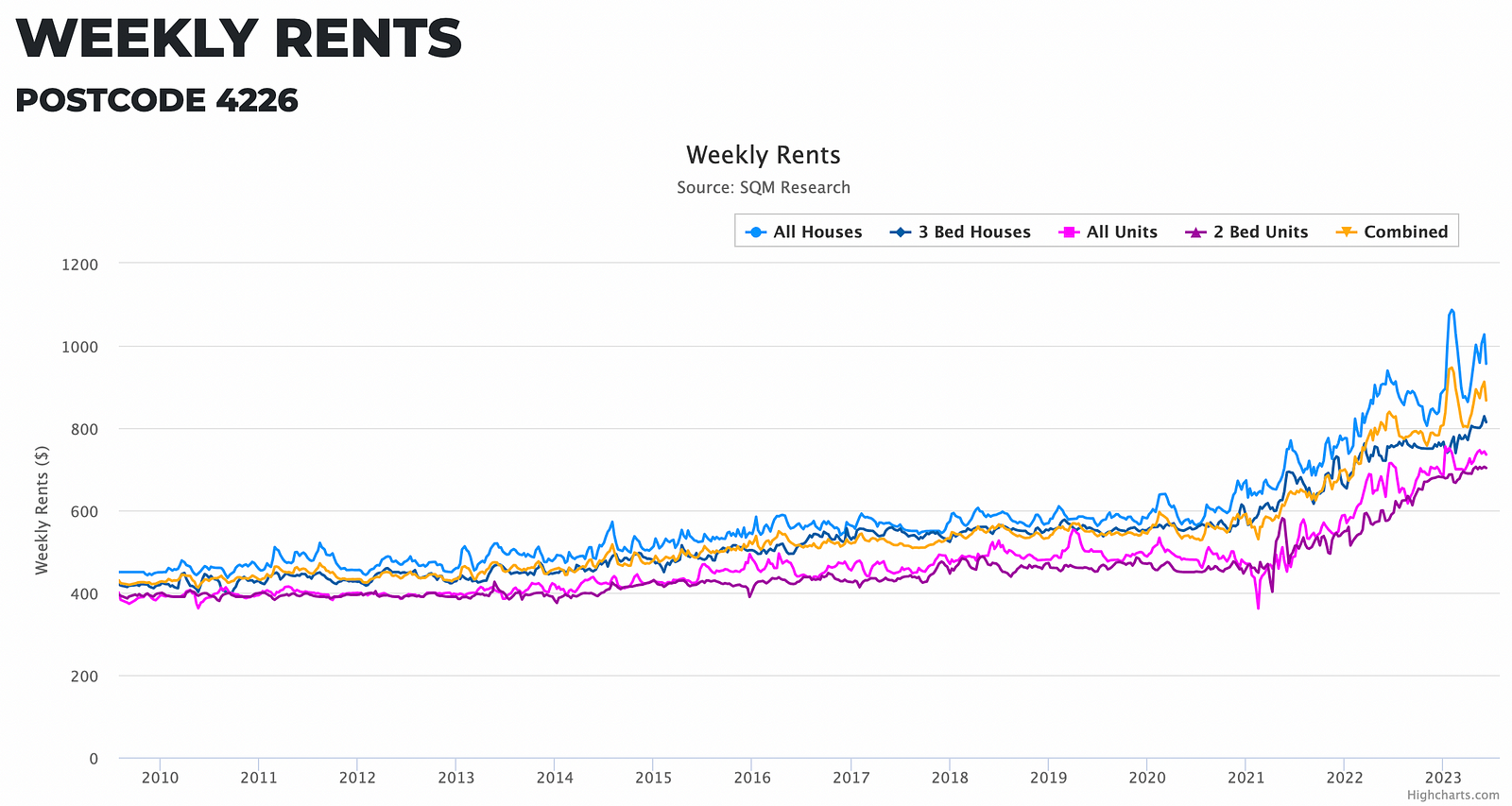

Chart by SQM Research— Weekly Rents Robina

Chart by SQM Research— Weekly Rents Varsity Lakes

Free markets don’t conform to our forecasts. They are however a way to understand our behaviour.

When you compare the above charts for when median price started to rise (February 2021) to when the vacancy rate hit the bottom (February 2021) you can see there is a correlation with weekly rents rising too for both suburbs.

Less units available to rent causing the rental price to rise and at the same time median sale prices rising all fuelled by the steady 1.8% increase in population since 2022 for Robina.

A recent study by Kent Lardner, Property Data Analyst of suburbtrends ‘Australia’s Rental Crisis: The 10 Worst Affected Areas’ showed Robina as being the third least affordable in Australia where renters were spending an average of 41% of their income on rent. That’s 11% above the recognised standard threshold.

It’s clear rents are through the roof (no pun intended) and why pay a landlord if you can pay your own mortgage.

However you choose to digest all these numbers the bottom line is times are tough for Gold Coaster’s and those lucky enough are buying instead of renting.

A shift in expectation of where to live and type of dwelling seems to be evolving as the lack of supply and continuing population growth puts further pressure on those renting and looking to buy.

More and more people are running out of options but if you have that option ‘It’s not timing the market, it’s time in the market’.

Matthew Gibson

June 16, 2023

‘Australia’s Rental Crisis: The 10 Worst Affected Areas’ by Kent Lardner https://www.suburbtrends.com/research/australias-rental-crisis-the-10-worst-affected-areas?ss_source=sscampaigns&ss_campaign_id=648937e26a0add35b5b554e6&ss_campaign_name=June+Suburbtrends+Update&ss_campaign_sent_date=2023-06-14T05%3A28%3A05Z

Matthew Gibson

Keen researcher and on the ground Gold Coast Buyers Agent